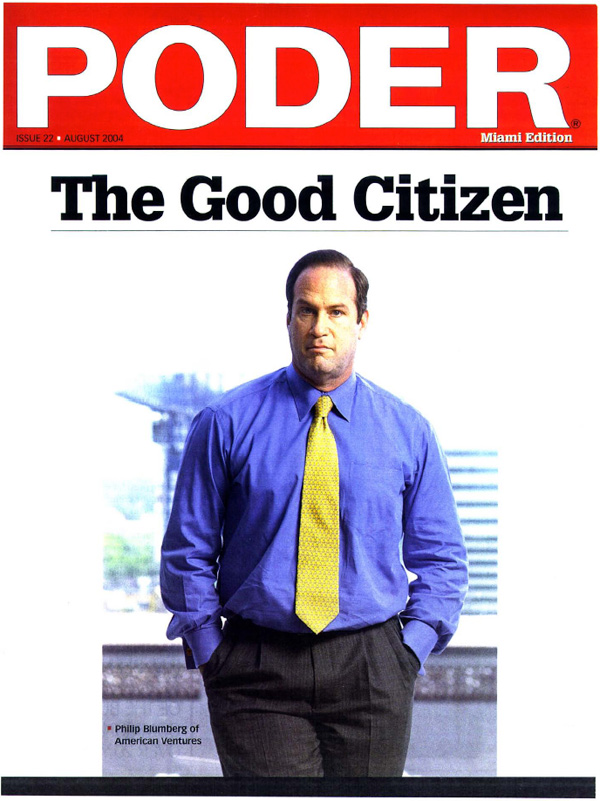

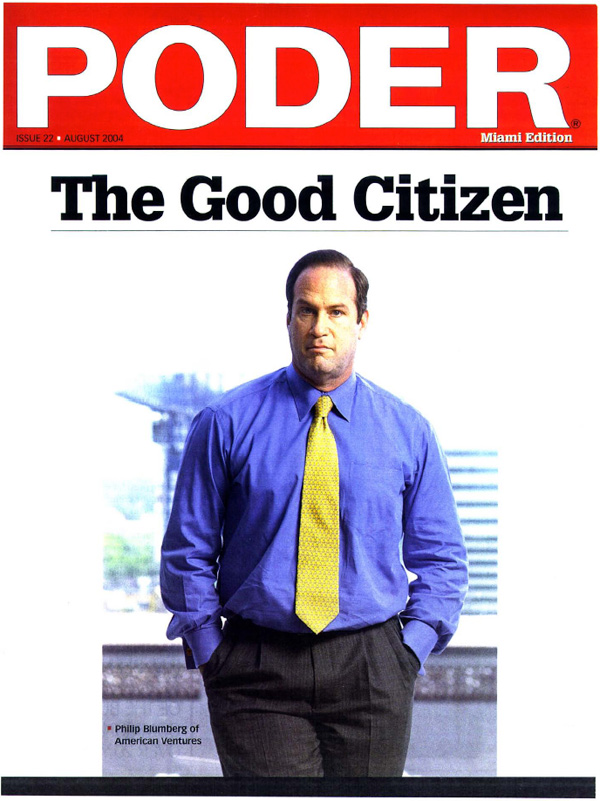

The Good Citizen, Profile of Philip Blumberg

Poder Magazine

Blending entrepreneurship and civic mindness, Philip Blumberg has transformed American Ventures into a main real estate player.

Blending entrepreneurship and civic mindness, Philip Blumberg has transformed American Ventures into a main real estate player.

Civic leader, devoted father, and successful entrepreneur, Philip Blumberg transformed American Ventures, once a one-man company, into one of the most stable and successful investment management institutions in the South.

Philip Blumberg walked into Cafe Abracci for lunch as if it were his own dining room. He greeted the owner and walked right to the best table, the only one from which you can directly face the door of the renowned Coral Gables restaurant. His suit sleeves were unbuttoned. (A bit of carelessness or a subtle display of wealth? Only tailor-made suits can be unbuttoned.) He ordered a glass of red wine and leaned back to begin the interview.

Who can blame him for his demeanor? He’s done well for himself. Blumberg presides over and owns one of the major commercial real estate companies in the southern United States. American Ventures, the company he founded in 1979, now offers a full range of commercial real estate and investment management services to national, international, and regional institutions. He oversees the investment strategy of funds of several hundred millions of dollars.

Somehow, despite his success, he still manages to keep his feet on the ground. A picture of his first office in 1983 hangs in one of the main conference rooms of his office. (He currently owns the entire building.) The picture shows a run-down converted garage, of which he only had half of, to remind him of where he began. “You can be a little seduced by our own surroundings,” he explains. “The picture suggests that everyone is vulnerable.”

He is known for his business savvy and civic leadership and also for his pranks. The interview begins. “What do you do Philip?” He responds with a straight face, “Oh, so you want to go straight for the jugular? Could you be a little less intrusive?” His sense of humor undoubtedly contributes to his down to earth manner.

“He’s wicked, he’s really wicked,” jokes his old friend Commissioner Johnny Winton. “He always has something mischievous in mind.” Truth is, Winton praises Blumberg’s intelligence, candidness and life-loving attitude. Blumberg has been an active figure in the business community for over 20 years and is well known for his straightforwardness and outright disregard for social conventions. He is the man you want to have a beer with and the man you want next to you in the most important professional meeting of your life. Winton warmly recalls the time Blumberg surprised him by attending Winton’s father’s funeral. “I had tried to maintain my composure through the ceremony, but I totally lost it when I saw him.”

“Blumberg wears his heart on his sleeve,” says Miami-Dade mayoral candidate Jose Cancela. Cancela met Blumberg in 1988 through his involvement in the Greater Miami Chamber of Commerce. “He is an ethical man who stands up for what he believes.” Cancela also credits Blumberg with single-handedly securing a Knight Foundation grant of approximately $400,000 for a higher-education initiative. Blumberg currently serves as executive vice-chairman of the chamber’s South Florida Initiatives Program, which has as a cornerstone a consortium for higher education. Funded by the Knight Foundation, the consortium is an attempt to coordinate the efforts among the area’s colleges and universities. Since its inception, it has partnered with organizations such as Enterprise Florida and has distributed about 30,000 copies of a booklet on the facts and figures of the economic impact of higher education in South Florida.

Knight Foundation, one of the top ten foundations in the United States, is also an investor in several American Ventures funds. Hodding Carter III, president of the Knight Foundation, says, “Philip Blumberg is the quintessential businessman as good citizen and good citizen as businessman. He knows how to make a profit, but he also knows that we all live in community.” The Knight Foundation is also an investor in two of Blumberg’s funds. “The Foundation is lucky to have him as a partner,” adds Carter.

Blumberg was chairman of the Greater Miami Chamber of Commerce from 2000-2001; he serves on the Florida Chamber of Commerce’s board of directors and is a member of the Florida Council of 100, appointed by the governor. He is a member of the Board of Trustees of the University of Miami, the Beacon Council and the Miami Business Forum, among other organizations.

“I haven’t said ‘no’ as many times as I should,” says Blumberg. He believes that though he has been involved in a number of organizations, his contributions are marginal. He says his civic involvement has to do with the way he was raised. “My father was civically very active, and I am a very poor copy of my father. He was my hero and I admire him beyond anybody.” Also, he explains, that when you’re in real estate, you don’t have a choice but to have an impact. “You can’t pick up your building and leave. I believe in enlightened self-interest.”

Though Blumberg operates behind the scenes to mediate conflict most of the time, he is not afraid of public confrontation or challenging political leaders. His vocal opposition to a baseball stadium on park land downtown proposed by County Mayor Alex Penelas and his leadership of reform at Miami International Airport are examples of many occasions in which Blumberg put himself in the line of fire for what he believed was an important issue. “I don’t mind getting into controversy,” says Blumberg, “even with political officials, you need to stand up for what you believe. Why would it be rewarding to take a leadership position and then not do anything with it?”

A Miami native, Blumberg left for college at the University of North Carolina and later attended Harvard Business School. After a brief stint at Lehman Brothers in New York in the mergers and acquisitions division, he returned to his hometown to work in development. Though his father was a successful real estate developer, credited with the development of Cutler Ridge, Blumberg decided to start his own firm. “I think it was youthful ego, and not wanting to be a part of a family business,” he explains.

In 1979, he founded American Ventures as a general contractor, doing townhouse projects in Broward. His time in Lehman Brothers taught him to focus on what opportunities existed in capital markets, as real estate is a capital-intensive industry. At the time, in the early 1980s, there was not a lot of institutional equity in real estate. Blumberg started a small research area to support the company’s primary business of real estate development, leasing and management, having learned at Lehman the importance of making recommendations with a basis beyond just “guy feel.” Currently, his research division RealData maintains a comprehensive database, tracking 27 primary markets in the South, 24 markets in Florida, and more than 1,500 individual properties and projects on a quarterly basis.

His company grew steadily during the 1980s, but in 1989, the real estate industry slid into the most severe depression of the last century, driven by overbuilding, a change in tax laws and the collapse of the S&Ls. It caused those who were doing development to disappear, and they went into property management and leasing, explains Blumberg. American Ventures followed suit, doing institutional management of properties. Even so, American Ventures became among the largest shopping center managers in South Florida and one of the largest office managers.

Unhappy with the structure of his business because he believed he had the capability to execute a good investment strategy but lacked the capital, he started an institutional investment fund in 1992. The fund performed very well, and by 2000, the average annual return was 23.5%. Blumberg attributes his firm’s success to his policy of minimizing risk, and being conservative in interest rates and financing. The company has been around for over 20 years in a very risky industry and has only grown through internal growth. Currently, American Ventures employs approximately 100 people across the country. In 2001, Blumberg started an open-end fund that owns properties in the Southeast and Southwest, and in 2003 he stared mezzanine debt funds for projects in the Southwest and in South Florida.

Since August 1992, when American Ventures began providing investment management services to institutional investors, through June 2002, the annualized time-weighted total return to investors, net of fees, for the composite of all American Ventures’ managed investments was 19.22%. Over the comparable period, the average annual time-weighted total return reported by the National Council of Real Estate Investment Fiduciaries for all properties in its National Property Index was 8.82%. Likewise, the National Association of Real Estate Investment Trusts reported 11.86% average annual time-weighted total return for its REIT index for that time frame.

Blumberg is currently looking to expand to the Northeast and Midwest and is working on launching a fund for non-U.S. investors (the fund will be of about $500 million), which would be with tax issues in mind and have a conservative investment strategy to contain downside risk, while taking advantage of a variety of different investment strategies to help ensure strong returns.

His firm has seen unprecedented growth in the last few years and Blumberg is eager to expand. As our lunch ends he has a speech to prepare for a state Legislature meeting regarding urban development, a meeting scheduled with the embattled Miami International Airport Director Angela Gittens, and later, he has to pack for a camping trip with his three children. Blumberg certainly keeps busy.

Full story (PDF,1236KB).

Keywords: American Ventures, Philip Blumberg, Poder, profile

Blending entrepreneurship and civic mindness, Philip Blumberg has transformed American Ventures into a main real estate player.

Blending entrepreneurship and civic mindness, Philip Blumberg has transformed American Ventures into a main real estate player.