To download the Term Sheet please click here.

If you would like additional information on investment opportunities, please contact Ludovic Roche at lroche@blumbergcapitalpartners.com or via phone at +1 (305) 569-9500.

Blumberg Strategic Asset Fund Term Sheet

A diversified, tax-efficient, closed-end real estate investment fund with certain liquidity features (the “Fund”) intended to invest in real estate and real estate related assets with the objective of making not less than 75% of its investments in assets in the United States, designed for non-U.S. institutional and high net worth investors (the “Investors”) seeking to diversify their portfolios. Distributions to Investors from the vehicle are anticipated to be exempt from U.S. taxes. The Fund will be managed by a member of the Blumberg Capital Partners (formerly known as “American Ventures”) group of companies (the “Manager”).

- Subscriptions and Drawdowns — Investors must subscribe to their investments in the Fund within eighteen months of the initial closing, which is expected to be in the fourth quarter of 2009, although the Fund may extend the subscription period by six months. Investors’ commitments may be drawn down by the Fund in a single draw, or at the election of the Fund, in multiple draws during the 3 year period from the end of the subscription period.

- Amount of the Fund — The targeted amount of the Fund is U.S. $1 Billion. The Fund reserves the right to accept commitments in a greater or lesser aggregate amount.

- Investment Opportunities — We believe this is an historic opportunity for non- U.S. investors to participate in an investment vehicle which has a highly diversified U.S. real estate related investment strategy, taking advantage of the cyclicality of the current highly depressed market for commercial real estate and real estate related debt, and sponsored by an entity which has traditionally over the past 17 years afforded investment opportunities only to the largest U.S. institutional investors, commercial banks and pension funds.

- Investment Strategies — The Fund will invest in 3 core areas, all related to real estate: hard assets, debt, and REIT shares and other equity interests.

- The specific areas of interest from time to time will be dictated by market developments, and will be selected based upon the most attractive available risk-adjusted returns, consistent with the Fund’s investment objectives. This flexibility will enable Investors to more fully benefit from rapidly evolving market conditions.

- Targeted Returns — The portfolio of investments are anticipated to produce in excess of a 20% average annual return* over the life of the Fund.

- Tax Treatment of Distributions to Investors — Investors are expected to receive annually an approximate 8% return on their interests in the Supplemental Sub-Fund, roughly equivalent to a 4% annual return on their overall investment in the Fund, free of U.S. or Cayman Islands tax. In addition, distributions to Investors of the net after-tax gains from sale of the Fund’s underlying real properties are expected to be free of U.S. or Cayman Islands withholding tax (FIRPTA). In addition, Investors who are not otherwise subject to tax in the U.S. or the Cayman Islands are not anticipated to have any U.S. tax reporting obligations as a result of investing in the Fund.

- Liquidity — The Fund intends to provide Investors with significant liquidity through current income distributions and a self-liquidating, closed-end structure, supported by a facility for internal redemption and market-making by the Fund. Blumberg Capital Partners believes that these features will provide substantial liquidity.

- Internal Redemption — Each Sub-Fund will have a subsidiary (a “Liquidity Subsidiary”) that will have limited amounts of capital available to repurchase interests in the related Sub-Fund. The Liquidity Subsidiaries will also make previously repurchased interests available for resale. Each Sub-Fund will have discretion over the amount of resources available to its Liquidity Subsidiary, the amount of interests eligible to be repurchased or resold, and the repurchase and resale prices for the interests. This redemption mechanism should assist Investors with a need for the return of some or all of their investment in the Fund prior to Fund termination, while accreting value to the remaining Investors in the Fund, given the prices at which the interests are expected to be repurchased and resold. The Liquidity Subsidiaries may make purchases and sales only within 45 days after a determination of NAV, which occurs once a year.

- Self-Liquidating — In addition to the anticipated current annual 8% (targeted) income distributions on the investment in the Supplemental Sub-Fund, as noted above, the Fund will provide distributions to Investors as investments (including debt investments) are liquidated after the fifth anniversary of the final closing. This self-liquidating feature should ensure progressive return of capital and profits to Investors commencing after the fifth anniversary of the end of the subscription period.

- Currency Hedging — The Fund intends to provide protection to Investors who wish to hedge against risks of a decline of the U.S. dollar against the euro, at their option and their expense, through a subsidiary (the “Hedging Subsidiary”) of the Equity Fund. Subject to the market availability of options on terms satisfactory to the Hedging Subsidiary, the Fund will offer Investors the ability to elect to purchase, from or through the Hedging Subsidiary, currency hedging options (the “Options”), warrants, structured notes, or other currency hedging instruments from time to time, designed to afford them protection of their investment, and any appreciation in their investment, against such a decline. This election would be entirely optional on the part of Investors, and would be made by Investors in their Subscription Agreements. The Options are not intended to provide 1:1 protection against any such decline which may occur, but rather, will be structured to have a “strike price” above the then current spot market currency exchange rate, so as to afford protection against a major decline of the dollar relative to the euro, should this occur, and to do so on what is anticipated to be a cost effective basis.

- Term — After the fifth anniversary of the end of the subscription period, the Fund expects to begin distributing to Investors the net proceeds from the disposition of its investments. The Fund is expected to be fully liquidated before the eighth anniversary of the end of the subscription period. However, the term of the Fund may be extended for up to four years at the discretion of the Fund if it then believes that doing so is more likely than not to increase the returns to Investors.

- Fees — The Fund Manager receives and retains a 1.5% annual asset management fee for its services. The Fund Manager collects an additional 1% annually, which is paid to placement agents for investor relations services (or refunded directly to investors who are not assisted by such agents). The fee is paid quarterly and calculated on the higher of (i) the most recently determined NAV of the Fund, including the amount of unfunded Investor commitments, or (ii) the original capital paid or committed to be paid to the Fund, minus any prior distributions of such capital to Investors. In the case of an Investor who is not represented by a placement agent, however, 1% of this fee will be refunded annually to the Investor, resulting in a net annual asset management fee burden of only 1.50%.

In addition, once Investors have received a preferred average annual return (the “Preferred Return”) of 8% on their investment during the life of the Fund, an affiliate of the Manager or its designee will be entitled to receive, from income or gains in excess of the Preferred Return, an incentive-based fee equal to one-fifth of that Preferred Return. Thereafter, such Manager affiliate or its designee will be entitled to an incentive fee equal to 20% of any further income or gains realized by the Investors above the Preferred Return.

The Manager and its affiliates will not charge the Fund any property financing or loan origination fees. However, the Manager or its affiliates will charge the Fund an asset acquisition fee (in Fund investment units, cash, or some combination of the two) of .75% of the gross purchase price of the asset.

In general, the Fund’s fees and cost structure are believed to compare favorably with those charged by other funds investing in U.S. real estate and targeting a similar investor base.

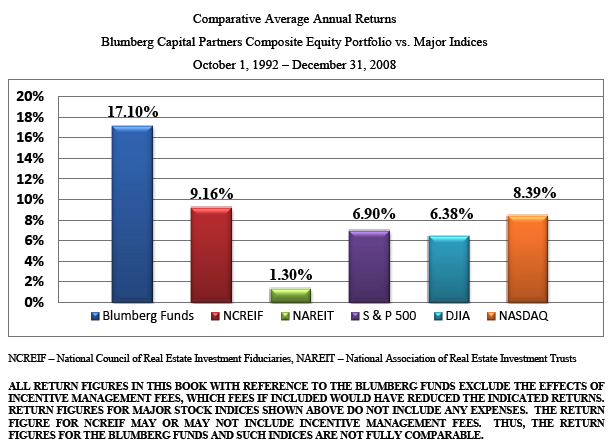

- The Sponsor — Blumberg Capital Partners and its affiliates and predecessors, established as early as 1979, have strong experience in real estate investment, and have sponsored and operated highly-successful fully discretionary institutional funds focused on equity investments in real estate. For 17 years the investment performance of the Funds has compared favorably to major U.S. equities indices as well as most other comparable U.S. real estate investment funds. Its investors have primarily been major U.S. pensions, foundations and commercial banks. This is the first opportunity ever for individuals and smaller institutional investors and non-U.S. investors to participate in a Blumberg Capital Partners-sponsored fund.

- Ownership of Properties — Each real estate equity investment will be owned through a separate legal entity. This structure will permit separate liquidation of each property owned by the Fund and the prompt distribution of the net proceeds of that particular liquidation to the Investors, on what is anticipated to be a tax-free basis in the United States and the Cayman Islands.

- Joint Ventures — The Fund may invest in real estate with other real estate investors, including vehicles managed by Blumberg Capital Partners, such as the Blumberg Property Fund, L.P. This would provide an opportunity for Investors to participate with other major investors, including U.S. institutions, in diversified real estate investments.

- Leverage — The Fund will employ third-party leverage on a case-by-case, risk- adjusted basis in a manner intended to increase returns to Investors, but without excessive risk under the circumstances.

- Limited Liability — No Investor will be liable for any debt of the Fund or be required to contribute any capital other than the initial subscription price.

- Reporting — The Fund will report its NAV and other financial information to Investors annually. The Fund’s annual report will be audited. The Fund will provide unaudited interim quarterly reports.

- Property Management — Properties may be managed and leased by Blumberg Realty Corporation, a vertically integrated organization. That company, along with its predecessors and affiliates have provided property management and leasing services to the Blumberg Capital Partners-sponsored equity funds since 1992.

- Professional Advisors — U.S. legal counsel is Locke Lord Bissell & Liddell LLP; Cayman Islands counsel is Maples & Calder; tax counsel is Hunton & Williams LLP; United Kingdom counsel is Clifford Chance LLP; and U.S. securities counsel is Arent Fox LLP. The Accountants will be a to be identified “Big 4″ accounting firm. The administrator will be Apex Fund services Ltd, which is based in Bermuda.

*On a pre-tax basis, net of management fees and other expenses (other than management incentive fees, returns and other compensation); actual returns may vary, and prior performance does not guarantee future results.

NOTICE OF PATENT PENDING: The investment structure discussed and disclosed herein and other related methods are the subject of a U.S. Patent Application.

NOTICE OF COPYRIGHT CLAIM: Copyright © 2009 by Blumberg Capital Partners. All rights reserved.

THIS DOCUMENT IS NOT AN OFFERING DOCUMENT. IT DOES NOT PURPORT TO BE A COMPLETE DESCRIPTION OF THE FUND, FOR WHICH THE READER MUST REFER TO THE FUND’S PRIVATE PLACEMENT MEMORANDUM. IT HAS BEEN PREPARED SOLELY TO ASSIST REPRESENTATIVES OF PROSPECTIVE PLACEMENT AGENTS IN OBTAINING A BASIC UNDERSTANDING OF THE INVESTMENT VEHICLE DESCRIBED, AND TO SOLICIT THEIR INPUT, AND MAY NOT BE DISTRIBUTED TO OR SHARED WITH THIRD PARTIES WITHOUT THE PRIOR WRITTEN CONSENT OF BLUMBERG CAPITAL PARTNERS. THIS DOCUMENT SUPERSEDES IN ITS ENTIRETY ANY TERM SHEET DESCRIBING THE PROPOSED OFFERING DATED EARLIER.

If you would like additional information on investment opportunities, please contact Ludovic Roche at lroche@blumbergcapitalpartners.com or via phone at +1 (305) 569-9500.